Curious about Bernie Madoff’s net worth at death?

Bernie Madoff, a former American stockbroker and financier, was infamous for orchestrating one of the largest Ponzi schemes in history. Over a period of several decades, Madoff defrauded thousands of investors out of billions of dollars through his investment firm, Bernard L. Madoff Investment Securities LLC. Despite being caught and sentenced to 150 years in prison, the question still remains: what was Bernie Madoff’s net worth at the time of his death?

To understand the answer to this question, it is important to first examine the extent of Madoff’s fraudulent activities and how he managed to deceive so many investors for so long. Additionally, it is necessary to take a closer look at Madoff’s lavish lifestyle prior to his arrest and sentencing, which provides insight into how he was able to maintain such an elaborate scheme for as long as he did. By exploring these factors in greater detail, we can begin to unravel the complexities surrounding Bernie Madoff’s net worth and what it means for those impacted by his crimes.

Overview of Bernie Madoff’s Fraudulent Activities

Bernie Madoff’s fraudulent activities spanned several decades, during which he orchestrated a Ponzi scheme that defrauded investors of billions of dollars through false investment returns and falsified financial statements. Madoff began his career as a legitimate stockbroker in the 1960s before starting his own investment firm, Bernard L. Madoff Investment Securities LLC (BLMIS), in the late 1980s. However, by the early 1990s, Madoff had already begun to engage in fraudulent activities.

Madoff’s family was also involved in his scheme, with his brother Peter serving as the chief compliance officer at BLMIS and his sons Andrew and Mark working at the firm as traders and co-directors of trading operations. Despite numerous investigations into BLMIS over the years, including one by the SEC in 2005 that found no evidence of fraud despite multiple red flags, it wasn’t until December 2008 that Madoff finally confessed to running a massive Ponzi scheme that had been ongoing for decades.

Madoff’s Lavish Lifestyle

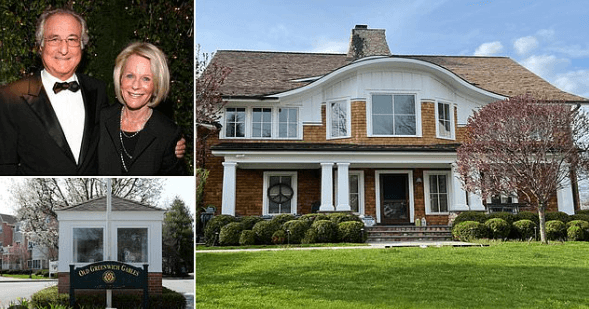

The opulent lifestyle that Madoff led, with its lavish spending and extravagant indulgences, was a glittering façade that hid the true extent of his financial fraud. Madoff’s wealth allowed him to live in luxury estates, own multiple yachts, and fly on private jets. His expensive tastes extended to jewelry and designer clothing for himself and his family. Despite the outward appearance of success, Madoff’s lifestyle was funded by the money he had stolen from his clients.

Madoff’s extravagant purchases included a penthouse in Manhattan worth $7 million, a mansion in Palm Beach worth $12 million, and a villa in France worth $1.3 million. He owned several yachts named after members of his family – Bull, Sondra, Karen – each costing millions of dollars. Madoff also purchased expensive art pieces by famous artists such as Picasso and Monet. His wife Ruth was known for her collection of expensive jewelry which included diamond necklaces and bracelets valued at over $2 million. All these luxurious purchases were made possible due to Madoff’s fraudulent activities that went undiscovered for several years.

The Discovery of Madoff’s Ponzi Scheme

Uncovering the intricate web of deceit that was Madoff’s Ponzi scheme required years of meticulous investigation by government regulators and financial experts. It all started in 2008 when Madoff’s sons, Mark and Andrew, confessed to their father that they suspected his investment advisory business was a fraud. This confession led Madoff to finally reveal his crimes to them, which ultimately resulted in his arrest and conviction.

Madoff’s early career as a legitimate stockbroker helped him establish himself as a trusted figure in the financial world. However, it wasn’t until the involvement of his family members that he was able to pull off one of the biggest financial scams in history. His brother Peter served as Chief Compliance Officer while his two sons held key positions in the company. As a result, Madoff was able to maintain an appearance of legitimacy for several decades before being exposed. The table below highlights some key events leading up to the discovery of Madoff’s Ponzi scheme.

| Year | Event |

|---|---|

| 1960s-1970s | Bernie Madoff establishes himself as a legitimate stockbroker |

| 1980s-1990s | Formation and expansion of Bernard L. Madoff Investment Securities LLC |

| Dec 2008 | Mark and Andrew Madoff confess suspicions about their father’s business |

| Mar 2009 | Bernie Madoff pleads guilty to 11 counts related to fraud and is sentenced to 150 years in prison |

Madoff’s Arrest and Sentencing

Following the arrest of Bernard Madoff, the Securities Investor Protection Corporation (SIPC) received over 16,000 claims from victims seeking compensation for their losses. In March 2009, Madoff pleaded guilty to eleven federal crimes and was sentenced to 150 years in prison. His plea deal included a forfeiture of $170 billion in assets and left many investors with little hope of recovering their lost funds.

The public response to Madoff’s arrest and sentencing was one of shock and outrage. Many investors who had trusted him with their life savings were left devastated by his actions. The media coverage of Madoff’s trial was extensive, with news outlets reporting on every detail of the case. Despite this attention, some critics argued that the media failed to adequately explain how a Ponzi scheme works or warn potential victims about similar scams in the future.

Attempts to Recover Lost Investments

Efforts to recover investments lost in the Madoff Ponzi scheme have been ongoing since his arrest and sentencing in 2009. The Securities Investor Protection Corporation (SIPC) has helped compensate investors who lost money in the scam, with payouts totaling over $14 billion as of 2021. However, some investors have faced legal challenges and difficulty recovering their full losses.

Several lawsuits have been filed against Madoff’s family members and associates for their involvement in the fraud, but these efforts have had limited success. In addition, some investors have faced challenges proving their losses or eligibility for compensation. Despite ongoing efforts to recover lost investments, many victims of the Madoff Ponzi scheme continue to face financial hardship and uncertainty about their future prospects for recovery.

The Status of Restitution Efforts

The magnitude of the Madoff Ponzi scheme’s impact on investors is highlighted by the ongoing restitution efforts, which have resulted in over $14 billion in payouts by the Securities Investor Protection Corporation. However, progress in these efforts has been slow due to legal challenges from some investors who claim that they are entitled to larger payouts than what has been offered.

Despite these challenges, there have been some recent developments in restitution progress. In 2020, a federal judge approved a plan to distribute an additional $568 million to victims. This distribution was made possible by settlements with several international banks and other entities that had facilitated Madoff’s fraud. While this represents a significant step forward, there are still many investors who have not received any compensation for their losses and continue to fight for their rights through legal channels.

Madoff’s Net Worth at the Time of his Death

Financial experts estimate that Bernie Madoff’s net worth was close to zero at the time of his death in April 2021. This is due to the fact that he had been serving a 150-year prison sentence and had already forfeited most of his assets, including real estate, cars, boats, and jewelry. However, there are still questions about the value of some remaining assets and whether they could be used to provide further restitution for victims of his Ponzi scheme.

Estimates from Financial Experts

According to estimates provided by financial experts, Bernie Madoff’s net worth at the time of his death is uncertain due to the complexity of his fraudulent scheme. Financial analysts have suggested that determining an accurate estimate for Madoff’s net worth would require a detailed analysis of his offshore accounts and other assets hidden from public view. However, given that much of Madoff’s wealth was acquired through illegal means, it is unlikely that any remaining assets would be accessible to his victims or their families.

Despite the difficulties in estimating Madoff’s net worth, financial experts have speculated on what it might have been prior to his arrest and conviction. Some have suggested that he may have had a net worth in excess of $1 billion before his Ponzi scheme unraveled. Others believe that this figure may be overstated, as much of Madoff’s wealth was simply illusory, created through fake account statements and other deceptive practices. Regardless of the exact amount, one thing is clear: Bernie Madoff’s legacy will forever be associated with one of the largest financial frauds in history and the devastating impact it had on countless innocent individuals.

The Value of his Remaining Assets

Estimating the value of Bernie Madoff’s remaining assets is complicated by the fact that much of his wealth was acquired through illegal means and therefore inaccessible to his victims. However, it is estimated that over $13 billion was lost in Madoff’s Ponzi scheme. The remaining assets are likely to be minimal compared to the size of the losses suffered by investors. In 2009, Madoff agreed to forfeit all his assets, including his homes, cars, boats and investments worth $170 billion. These were sold off as part of a settlement agreement with the US government. Any funds recovered from these sales have been distributed among Madoff’s victims through a court-appointed trustee.

The distribution plan for any remaining assets would depend on several factors including whether there are any legal claims against them and who has priority in receiving them. It is likely that any remaining funds will be distributed among those who suffered losses as a result of Madoff’s fraud on a pro-rata basis. However, some experts suggest that certain categories of victims may receive preferential treatment based on their circumstances and level of loss. Ultimately, whatever remains from Bernie Madoff’s estate will not come close to compensating the thousands of people whose lives he devastated through his fraudulent activities.

The Fate of Madoff’s Remaining Wealth

The fate of Bernie Madoff’s remaining wealth is currently a topic of interest given his passing. Reports suggest that at the time of his death, Madoff had roughly $18 million in remaining assets. However, it remains to be seen who will inherit this money as it is likely that much of it will be used to pay off the various legal settlements and restitution claims against him.

It is also important to note that any beneficiaries of Madoff’s estate may not necessarily receive all of the remaining assets. This is because any funds held in offshore accounts or hidden from authorities could potentially be seized by law enforcement agencies or creditors. As such, it is possible that even those who are designated as beneficiaries may only receive a fraction of what they were expecting.

The Impact of Madoff’s Fraud on the Financial Industry

The revelation of Bernie Madoff’s Ponzi scheme and the subsequent fallout has had a significant impact on the financial industry, leading to increased scrutiny and regulation. The high-profile nature of Madoff’s fraud brought attention to the lack of oversight and accountability in the financial sector, prompting lawmakers and regulators to take action.

Here are four ways that Madoff’s fraud impacted the financial industry:

- Increased regulations: In response to Madoff’s scheme, regulators have implemented stricter rules for investment firms and advisors, requiring more transparency and disclosure.

- Loss of investor trust: The scale of Madoff’s fraud led many investors to question their faith in the financial system as a whole, potentially causing lasting damage.

- Heightened enforcement efforts: Regulators have become more aggressive in pursuing fraudulent activity, increasing penalties for white collar crimes.

- Legal consequences: Many individuals associated with Madoff’s scheme faced criminal charges or civil lawsuits, including his family members who were involved in his business operations. These legal actions served as a warning to others engaged in similar activities that they could face severe punishment for their actions.

Overall, Bernie Madoff’s Ponzi scheme had far-reaching impacts on the financial industry that continue to be felt today through increased regulations and heightened awareness of fraudulent activity.

Lessons Learned from the Madoff Scandal

The Madoff scandal has taught us important lessons on the importance of due diligence, regulatory oversight, and the dangers of investment fraud. Due diligence is crucial in identifying potential red flags that may indicate fraudulent activities. Strong regulatory oversight can prevent individuals from engaging in fraudulent practices by enforcing regulations and holding wrongdoers accountable for their actions. The Madoff scandal also highlights the devastating impact investment fraud can have on investors’ lives and the broader financial industry, making it essential to remain vigilant against such practices.

The Importance of Due Diligence

Conducting thorough due diligence is crucial in the financial industry as it allows for a comprehensive evaluation of investment opportunities, minimizing the risk of falling victim to fraudulent schemes like Bernie Madoff’s Ponzi scheme. Due diligence best practices involve conducting extensive research on potential investments, including company background checks, financial analysis, and regulatory compliance. The importance of research cannot be overstated as it provides investors with critical information necessary to make informed decisions about their investments.

In addition to researching potential investments thoroughly, due diligence also involves understanding the risks associated with investing in certain industries or markets. This includes analyzing economic trends, market conditions, and geopolitical events that may impact investment performance. By conducting proper due diligence, investors can identify potential issues before committing their funds and take measures to mitigate risk. Ultimately, taking a meticulous approach to due diligence can help investors avoid costly mistakes and protect their finances from fraudulent activities such as those perpetrated by Bernie Madoff.

The Need for Strong Regulatory Oversight

Effective regulatory oversight plays a crucial role in maintaining the integrity of financial markets and protecting investors from fraudulent activities. The need for strong regulatory oversight has become increasingly pressing in the wake of high-profile cases such as Bernie Madoff’s Ponzi scheme, which defrauded investors out of billions of dollars. Regulatory reforms have been put in place to prevent similar incidents from happening again, including increased transparency requirements, stricter licensing procedures for investment professionals, and more robust enforcement mechanisms.

Investor education is also an important component of effective regulatory oversight. By educating investors about their rights and responsibilities, as well as warning them about common fraud schemes, regulators can empower individuals to make informed decisions and protect themselves from financial scams. This includes providing access to educational resources such as seminars, webinars, and online materials that teach investors how to spot potential red flags and report suspicious activity. Ultimately, a combination of strong regulation and investor education is necessary to maintain the integrity of financial markets and protect individuals’ hard-earned money from fraudsters like Bernie Madoff.

The Dangers of Investment Fraud

Investment fraud is a serious problem that can have devastating consequences for investors. It involves the use of deceitful practices to lure individuals into investing in fraudulent schemes, often promising high returns with little risk. The dangers of investment fraud are numerous and include potential financial losses, damage to one’s credit score, and even legal repercussions.

Prevention strategies are essential in mitigating the risks associated with investment fraud. Investors should educate themselves on the warning signs of fraudulent investments and conduct thorough research before making any financial decisions. Regulatory oversight is also critical in preventing investment fraud by ensuring that companies adhere to strict guidelines and ethical standards. In cases where individuals have fallen victim to investment fraud, recovery options may be available through legal action or government programs designed to assist victims. However, prevention remains the most effective means of combating investment fraud and protecting investors from its harmful effects.

The Future of Investment Fraud Prevention

The ongoing need for more comprehensive fraud prevention measures in the financial industry has become increasingly apparent, as high-profile cases like Bernie Madoff’s continue to highlight the devastating impact that investment scams can have on innocent individuals and communities. While traditional methods of preventing fraud, such as regulatory oversight and enforcement, have been effective to some extent, they are often insufficient in detecting and preventing sophisticated investment schemes. As such, there is a growing interest in exploring alternative approaches to combating investment fraud.

One potential solution lies in increasing investment education among consumers. By educating investors about common warning signs of fraudulent schemes and promoting transparency in financial transactions, individuals may be better equipped to protect themselves against investment scams. Additionally, technology solutions such as blockchain-based systems could potentially enhance transparency and accountability within the financial industry by providing an immutable record of all transactions. Ultimately, it will require a multi-faceted approach that encompasses both education and technology solutions to effectively combat the risks associated with investment fraud.

Additional Resources

Transitioning from our previous subtopic, which discussed the future of investment fraud prevention, we now turn our attention to additional resources that can aid in detecting and preventing such fraudulent activities. To effectively combat investment fraud, it is vital to rely on credible sources of information and investigative journalism.

One valuable resource for investors is the Securities and Exchange Commission (SEC). The SEC provides a wealth of information on investment opportunities and warns investors about potential scams. They also offer an online database known as EDGAR (Electronic Data Gathering, Analysis, and Retrieval system), which allows investors to access company filings and financial statements. This transparency helps investors make informed decisions based on accurate data.

In addition to governmental resources like the SEC, there are also independent investigative journalism outlets that provide detailed reports on fraudulent activities in the financial world. These outlets often conduct thorough investigations into companies suspected of engaging in illegal activity or misreporting financial data. By exposing these fraudulent practices, they help protect investors from falling victim to schemes like Ponzi schemes or other forms of investment fraud. Therefore, relying on credible sources of information can empower individuals with knowledge needed to avoid becoming victims of fraudulent schemes.

References

By consulting reliable sources of information and investigative journalism, individuals can shed light on fraudulent activities that threaten the financial world. In the case of Bernie Madoff’s net worth at death, many sources reported conflicting figures. However, it has been widely acknowledged that Madoff was convicted for running a massive Ponzi scheme that defrauded investors of billions of dollars.

The legal implications of Madoff’s actions were severe – he was sentenced to 150 years in prison and ordered to pay restitution to his victims. Investigative procedures used by authorities revealed the extent of his deception and led to the dismantling of his fraudulent operation. While his net worth remains unclear, it is certain that his legacy will forever be tarnished by one of the largest financial frauds in history.

Frequently Asked Questions

How did Bernie Madoff’s family react to his arrest and sentencing?

Bernie Madoff’s family reacted with shock and dismay to his arrest and sentencing. The aftermath of his Ponzi scheme had a devastating impact on their lives and legacy. Legal actions were taken against some family members, but they were not directly involved in the fraud.

What was the reaction of Madoff’s former clients to his death?

The death of Bernie Madoff elicited mixed reactions from his victims, some expressing relief while others lamenting the lack of closure. The legal consequences of his actions still loom large, with many seeking restitution for their losses.

Did Bernie Madoff express any remorse for his actions before he died?

There is no evidence that Bernie Madoff expressed any remorse for his actions before his death. Despite claiming personal accountability, he consistently blamed others and refused to fully acknowledge the harm he caused to countless individuals and institutions.

How did the media coverage of Madoff’s scandal impact the public’s perception of the financial industry?

The media coverage of Bernie Madoff’s scandal had a profound impact on public trust in the financial industry. It highlighted the need for stricter financial regulation and exposed the dangers of unchecked greed. The scandal led to greater scrutiny and oversight, which ultimately benefits society as a whole.

Are there any ongoing investigations into individuals or companies involved in Madoff’s Ponzi scheme?

Investigation updates reveal ongoing legal consequences for individuals and companies involved in Bernie Madoff’s Ponzi scheme. These investigations continue to uncover new evidence and prosecute those responsible for their involvement in the fraudulent activity.

Conclusion

Bernie Madoff, the mastermind behind one of the largest investment fraud schemes in history, passed away on April 14, 2021. He left behind a legacy of deceit and betrayal that impacted thousands of investors who lost their life savings. Madoff’s net worth at his death was estimated to be negative $17 billion due to court-ordered restitution and forfeiture.

Madoff’s Ponzi scheme lasted for over two decades and resulted in losses exceeding $64 billion. He promised high returns to investors but instead used new investments to pay off old ones, creating a fraudulent pyramid scheme that eventually collapsed during the financial crisis of 2008. Madoff lived a lavish lifestyle funded by his deception, owning multiple homes, yachts, and expensive cars.

Despite efforts to recover lost investments through lawsuits and settlements, many victims were unable to fully recoup their losses. The Madoff scandal highlighted the need for stronger regulations and oversight in the financial industry to prevent similar fraud from occurring in the future.

One interesting statistic is that nearly half of all victims were over the age of 65 when they invested with Madoff. This highlights how vulnerable older individuals can be to investment scams and reminds us of the importance of educating ourselves about financial decisions and seeking professional advice before investing our money. The Madoff scandal serves as a cautionary tale about greed and deception in the world of finance.